NS Heating Rebate

As winter approaches in Nova Scotia, many residents are concerned about the cost of heating their homes. Fortunately, the provincial government offers the ns heating rebate program to help eligible households offset some of these expenses.

When does the ns heating rebate come out?

The ns heat rebate 2024 typically becomes available in the fall, with applications opening around late September or early October. The exact dates can vary from year to year, so it’s important to stay informed by checking the official ns heating rebate website or contacting the program directly.

The ns heating rebate, for 2023 started accepting applications on October 15th and closed on March 31 2024. If you missed the deadline for the ns heating rebate 2023 2024 program year, you’ll need to wait until the next round opens up in fall 2024.

What is the winter heating allowance for pensioners?

Elderly residents, in Nova Scotia might qualify for heating aid apart from the ns heating refund. The Department of Seniors and Long term Care provides a Winter Heating Assistance program for individuals with income who are at least 65 years old and meet specific financial criteria.

The amount granted as part of the winter heating assistance for retirees can vary based on household income and size. In the 2023 2024 winter season a single senior earning than $29,000 annually could receive $200 whereas a couple with an income below $39,000 may be eligible, for $400. These amounts are in addition to the regular ns heating rebate 2023.

Is the renewable heat incentive still available?

The Renewable Heat Incentive (RHI) is a separate program from the ns heating rebate that encourages the adoption of renewable heating systems like solar water heaters, wood pellet stoves, and geothermal heat pumps. As of 2023 the RHI is still an option. There have been some updates, in times.

In 2022 the local government revealed intentions to phase out the RHI and introduce a Green Choice Program offering refunds for heat pumps and other energy efficient enhancements. New applications for the RHI will no longer be accepted after 2025 so if you’re keen, on benefiting from this offer for a heating system its advisable to take action. You may be able to combine the RHI with the heat pump rebates ns offered through Efficiency Nova Scotia.

Do Old Age Pensioners (OAP) get a heating allowance?

Certainly! Senior citizens, in Nova Scotia are eligible to receive a heating allowance via the Winter Heating Allowance program as mentioned earlier. This extra benefit complements the standard heating rebate provided to all qualifying households irrespective of age.

To be eligible, for the Old Age Pensioners (OAP) heating allowance individuals must be 65 years or older reside in Nova Scotia and meet the income criteria based on household size. You do not need to apply separately for this allowance – if you apply for the ns heating rebate and meet the criteria, you will automatically be considered for the additional OAP amount.

How much is the ns heating rebate?

The amount of the ns heating rebate 2023 depends on your household income and the type of heating fuel you use. For the 2023 2024 program year the maximum rebate amounts are as follows;

- $200, for households earning than $29,000

- $150 for households earning between $29,000 and $39,000

- $100 for households earning between $39,000 and $49,000

These rebates remain consistent regardless of whether you use electricity, oil, wood, propane or natural gas for heating. However if you utilize heating fuel types you can only seek the rebate for your source.

So what is the heating rebate amount for a household in Nova Scotia? Considering the income criteria, a family of four with an income of $80,000—around the median household income, in Nova Scotia—would not qualify for this rebate. The ns home heating rebate is targeted at lower-income households who are most in need of assistance.

What is the renewable heat incentive?

The Renewable Heat Incentive (RHI) is an initiative that offers incentives, to residents and businesses who choose to install approved heating systems. The main aim of the RHI is to lower carbon emissions and promote the expansion of the energy industry, in Nova Scotia.

Some types of heating systems that may be eligible for the RHI program are;

- Solar powered air and water heaters

- Wood or wood pellet heating units

- Heat pumps

- Biodiesel space heaters

The rebates provided through the RHI are calculated based on the systems heating capacity. Are distributed over a 7 to 10 year period. For instance a residential wood pellet boiler could receive a rebate of $1,200 for 7 years totaling $8,400 over time.

It’s important to note that the RHI is a separate program from the ns heating rebate and has its own eligibility criteria and application process. You may be able to receive both rebates if you qualify, but they are administered independently.

How does the heat pump rebate work?

Heat pumps are a way to save on energy bills and lessen your impact on the environment by providing heating and cooling solutions. If you’re considering installing a heat pump in your Nova Scotia home, you may be eligible for rebates through Efficiency Nova Scotia’s heat pump rebates ns program.

The amount of the heat pump rebate ns depends on the type and efficiency rating of the system you install. In 2023 the rebates vary from $200, for a split heat pump with a SEER rating of 16 to $1,500 for a ducted or centrally ducted heat pump with a SEER rating of 20 or higher. To be eligible for the Nova Scotia heat pump rebate you need to;

- Own a detached detached or row house, in Nova Scotia

- Install an approved heat pump model through a certified contractor

- Have an existing electric baseboard, furnace or boiler heating system

- Meet specific insulation and ventilation standards

- Agree to have your heat pump inspected post installation

You can apply for the heat pump rebate ns online through the Efficiency Nova Scotia website or by mail. The rebate will be issued as a cheque within 90 days of approval.

What other home heating rebates are available in Nova Scotia?

In addition to the ns heating rebate and the heat pump rebates ns, there are a few other programs that can help Nova Scotia homeowners with their heating costs and energy efficiency upgrades:

The HomeWarming Program offers energy assessments and home improvements such, as insulation, draft proofing and heat pumps to households with incomes. Eligibility is determined by household income and location.

Under the PACE Program (Property Assessed Clean Energy) homeowners can secure financing for energy efficiency upgrades. Repay it through their property taxes. Municipalities in Nova Scotia that offer PACE programs include Amherst, Bridgewater and New Glasgow.

Seniors aged 65 and above who reside in their homes can request a grant of up to $500 for assistance with home repairs and modifications including upgrades to heating systems. The grant amount is based on income criteria. Can cover eligible expenses.

The Affordable Multifamily Housing Program incentivizes the construction and renovation of housing units by offering rebates for installing energy efficient heating systems, like heat pumps.

Is the ns heating rebate taxable?

No, the ns heating rebate is not considered taxable income. You do not need to report the rebate amount on your income tax return or pay taxes on it.

However, it’s important to keep in mind that rebates like the ns heating rebate 2023 may be considered a reduction of your heating costs for the purposes of other tax credits or benefits. If you receive the Nova Scotia Affordable Living Tax Credit, which considers your household income and expenses getting the heating rebate might slightly lower the credit amount you qualify for.

If you’re unsure, about how these rebates affect your taxes or have any questions its recommended to seek advice, from a tax expert or reach out to the Canada Revenue Agency for assistance.

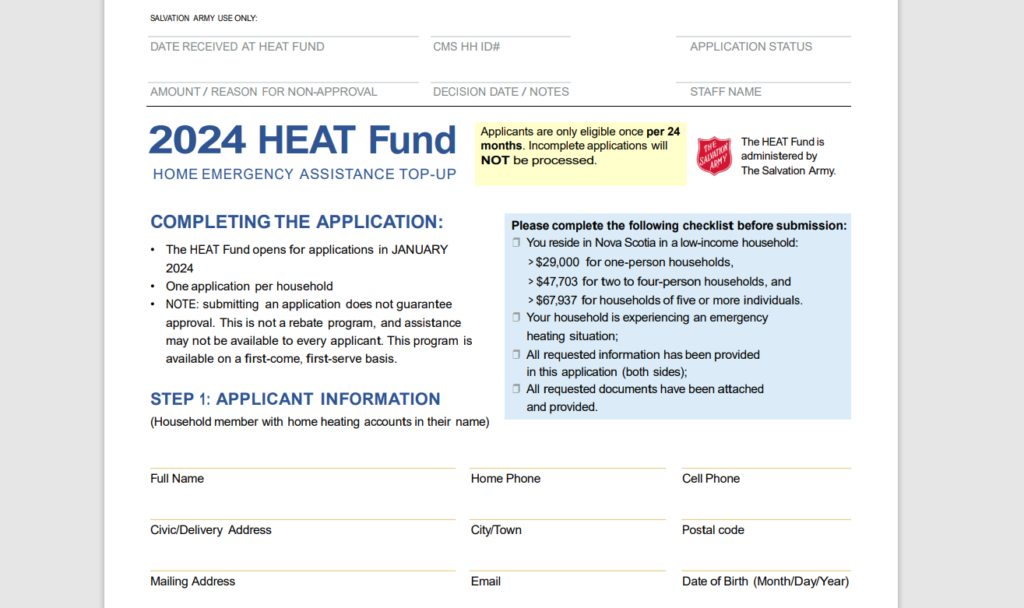

Who is eligible for the ns heating rebate 2024?

The eligibility criteria for the ns heating rebate 2024 have not been announced yet, as the program details are typically released in the fall of each year. However considering the requirements, for the Nova Scotia heating rebate in 2023 it is probable that the 2024 program will feature criteria. To qualify for the Nova Scotia heating rebate in 2023 or 2024 you must meet the following conditions;

- Reside in Nova Scotia and use electricity, oil, wood, propane, natural gas or other fuels to heat your home.

- Maintain a household income below $49,000 annually.

- Submit evidence of income and heating expenses for all household members.

- Apply solely for your residence (excluding vacation homes or rental properties).

- Ensure property taxes are fully paid (. Be enrolled in a payment arrangement).

Certain groups are automatically eligible for the Nova Scotia heating rebate such, as;

- Recipients of Income Assistance

- Residents of housing or cooperative housing

- Households benefiting from the Disability Support Program or Disabled Residential Rehabilitation Assistance Program

- Households receiving the Nova Scotia Housing Benefit

If you’re not sure whether you qualify for the ns heat rebate, you can use the online eligibility calculator on the program website or contact the program administrators for assistance.

Is the ns heating assistance rebate taxable?

No, the ns heating assistance rebate program is not considered taxable income at either the federal or provincial level. This means you do not need to report the rebate amount on your income tax return or pay taxes on it.

The ns heating rebate is considered a government assistance program, not employment income or investment income. It is created to assist families with medium incomes, in covering their heating expenses than serving as a taxable advantage.

Nonetheless getting the ns heating rebate 2023 or similar energy saving rebates might impact your qualification for income based tax credits or benefits. If you have any inquiries, about your circumstances it’s advisable to consult with a tax expert.

Is there a rebate for heat pumps?

Sure there are a variety of incentives offered for heat pumps, in Nova Scotia depending on the kind of system you set up and your qualifications for programs. Some of the heat pump rebate initiatives include;

Efficiency Nova Scotia Heat Pump Rebate; This program provides rebates of up to $1,500 for installing heat pump models in homes heated with electricity. The rebate amount is determined by the systems efficiency rating. Whether it is ducted or ductless.

Canada Greener Homes Grant; This federal initiative offers grants of up to $5,000 for energy upgrades, including heat pumps. To qualify you need to undergo a home energy assessment after the upgrades.

Renewable Heat Incentive; The RHI program offers rebates for heat pump installations and other renewable heating systems such, as solar and wood. The rebate value depends on the systems rated heating output. Is distributed over 7 10 years.

HomeWarming Program; Low income households may qualify for heat pump installations through the HomeWarming Program managed by the Clean Foundation and Efficiency Nova Scotia.To take advantage of these heat pump rebates ns, you will need to work with a certified contractor and ensure that your system meets the eligibility criteria for each program. You can also combine rebates from multiple programs to maximize your savings, as long as you meet the requirements for each one.

Who qualifies for the ns heating rebate?

To qualify for the ns heating rebate, you must meet the following criteria:

Residency: You must live in Nova Scotia and heat your primary residence with electricity, oil, wood, propane, natural gas, or other fuel. Cottages, rental properties, and business premises are not eligible.

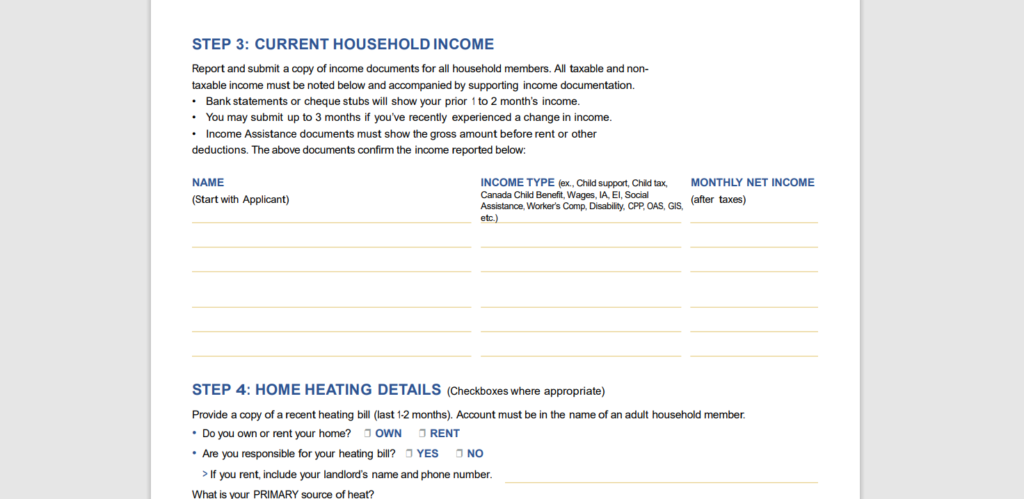

Income: Your household income must be under $49,000 per year, based on your most recent income tax return. This includes the income of all adults living in the household.

Heating Costs: You must provide proof of your heating costs, such as bills or receipts, for the previous year. If you use wood or another fuel that you don’t purchase from a supplier, you may need to provide an estimate of your costs.

Property Taxes: You must have paid your property taxes in full or be enrolled in a payment plan with your municipality. If you rent your home, your landlord must be up to date on their property taxes.

Other Assistance: If you receive Income Assistance, live in public housing or cooperative housing, or have received assistance from other programs like the Disability Support Program or the Nova Scotia Housing Benefit, you are automatically eligible for the ns heating rebate.

If you’re not sure whether you qualify for the ns heating rebate 2023 2024, you can use the online eligibility calculator or contact the program administrators for help. You can also check the status of your application online using your application number and postal code.

Final Thought

The ns heating rebate is a valuable program that can help low and moderate-income households in Nova Scotia offset their heating costs and stay warm during the winter months. By understanding the eligibility criteria, application process, and rebate amounts, you can take advantage of this assistance and potentially combine it with other energy efficiency incentives like the heat pump rebates ns.

If you have questions about the ns heating rebate 2023 2024 or need help with your application, don’t hesitate to reach out to the program administrators or consult with a qualified professional. With the right information and support, you can access the heating assistance you need to keep your home comfortable and affordable.